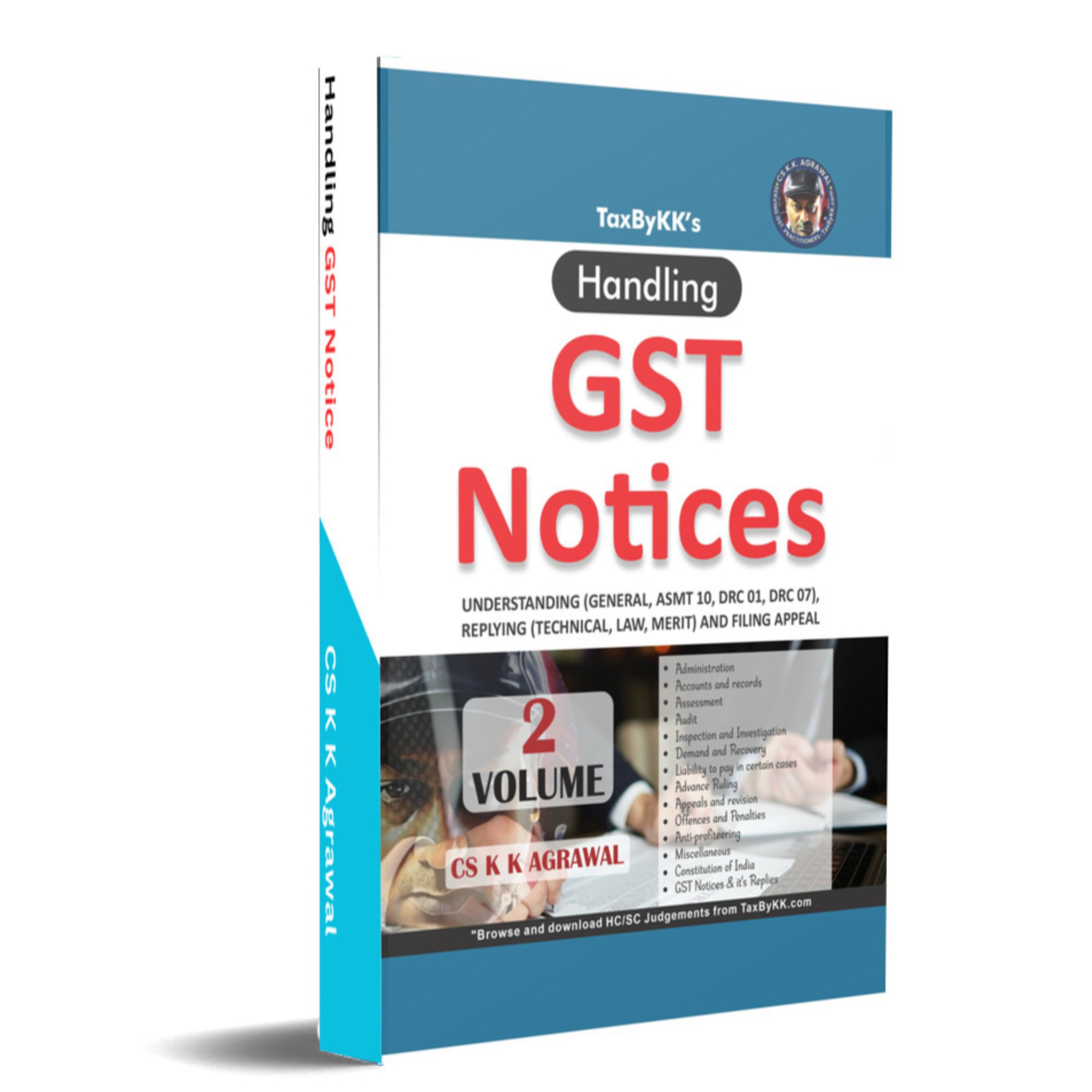

Handling GST Notices alongwith GST replies by CS Kaushal Kumar Agrawal

by

213 213 people viewed this event.

The book is centered around GST notices, exploring the various types of notices that can be issued by tax authorities and providing guidance on how to respond to them.

No of Pages: 305

Updated: till 10.05.2023.

| Administration | |

| 2. | Accounts and records |

| 3. | Assessment |

| 4. | Audit |

| 5. | Inspection, search and seizure |

| 6. | Demand and recovery |

| 7. | Liability to pay in certain cases |

| 8. | Advance Ruling |

| 9. | Appeals and revision |

| 10. | Offenses and Penalties |

| 11. | Anti Profiteering |

| 12. | Miscellaneous |

| 13. | Constitution of India |

| 14. | Transitional Provisions |

| 15. | GST Notices |