| Sr.No | Content |

|---|---|

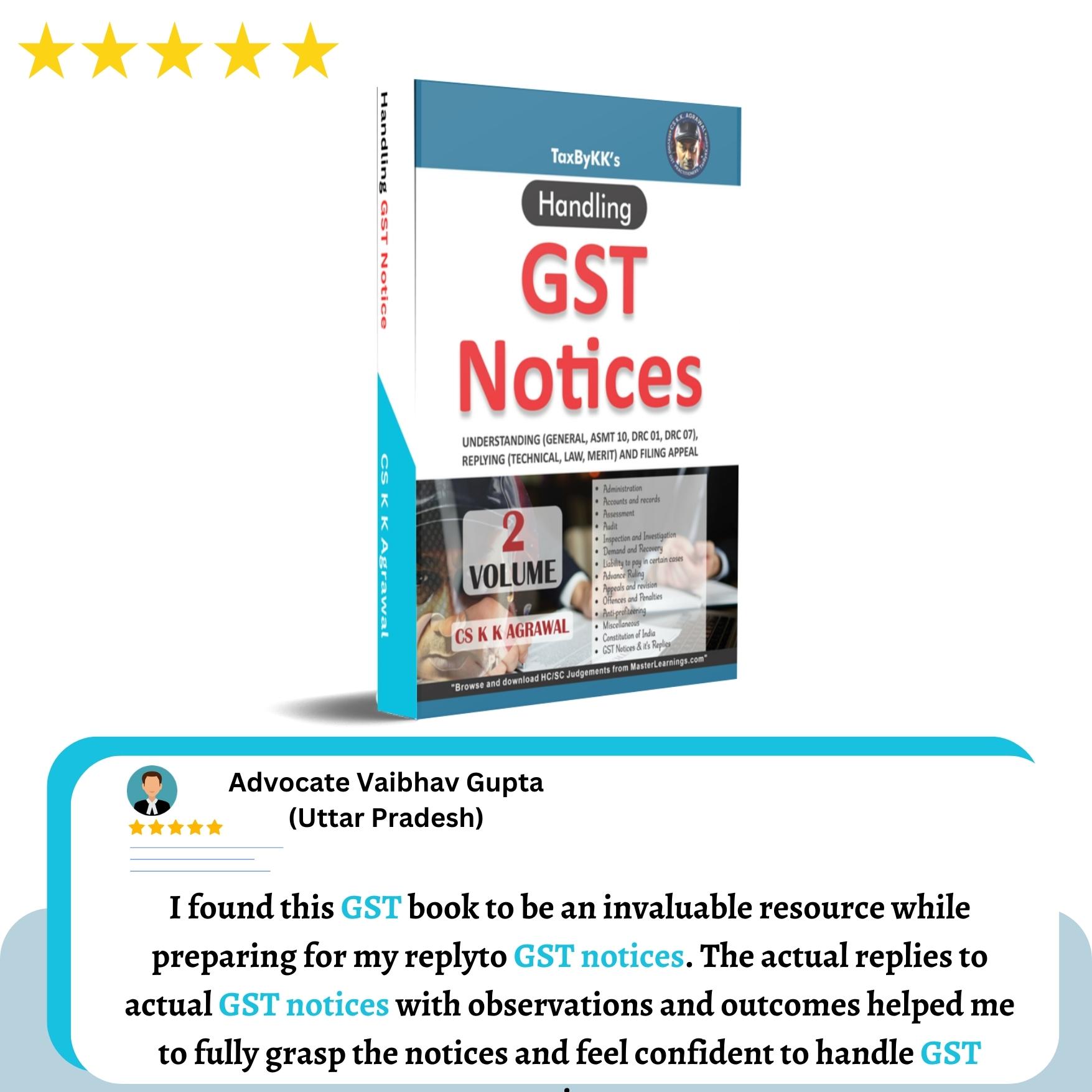

| 1. | Administration |

| 2. | Accounts and records |

| 3. | Assessment |

| 4. | Audit |

| 5. | Inspection, search and seizure |

| 6. | Demand and recovery |

| 7. | Liability to pay in certain cases |

| 8. | Advance Ruling |

| 9. | Appeals and revision |

| 10. | Offenses and Penalties |

| 11. | Anti Profiteering |

| 12. | Miscellaneous |

| 13. | Constitution of India |

| 14. | Transitional Provisions |

| 15. | GST Notices |

| Annexures | Actual GST Notices and their replies |

Reviews

There are no reviews yet.